[EN] Southeast Europe, EU’s cleantech blind spot

In the global cleantech race, the EU needs to leverage all its assets. Yet it systematically overlooks Southeast Europe, a region that combines competitive costs, abundant resources and the fastest company growth. Can the Clean Industrial Deal succeed with such a blind spot?

To navigate an increasingly challenging geopolitical and geoeconomic environment, the EU is betting on the Clean Industrial Deal to achieve competitiveness and decarbonisation.

To that end, the European Commission proposed to at least double EU funding for domestic cleantech innovation in the next EU budget (2028 – 2034). Programmes like Horizon Europe, InvestEU, Connecting Europe Facility would expand, new Funds and financing instruments are envisaged, and the Innovation Fund is expected to grow as carbon market revenues increase.

But will this additional funding translate into greater competitiveness and improved quality of life for Europeans ? The answer depends on how strategically resources will be deployed. However, current EU innovation funding shows that regions with strong potential remain structurally underfunded.

Southeast Europe is one such region, comprising the countries between the Danube, the Black Sea and the Mediterranean. In fact, in his announcement of the grids package from December 2025, Commissioner Jorgensen refers directly to this region in saying “we will work to advance our 8 Energy Highways – these are strategic projects addressing persisting bottlenecks in our system from the Baltic Sea to Cyprus, from South Eastern Europe to the Iberian Peninsula.”

Beyond competitiveness, how the Clean Industrial Deal performs in Southeast Europe could provide a blueprint of a successful industrial policy integration for enlargement candidates such as Moldova and Ukraine, as well as countries in the Western Balkans, showing how EU membership can deliver industrial transformation and a future-proof prosperity which does not come at the expense of a healthy environment.

For the purpose of our quantitative analysis, we focused on Bulgaria, Croatia, Cyprus, Greece, and Romania, keeping in mind that we interviewed innovators in parallel from Slovenia as well as Hungary.

SouthEast Europe is a highly industrialized region whose enterprise ecosystem grew faster than the rest of Europe over the past decade. Additionally, it has excellent enabling conditions for scaling cleantech, such as: abundant wind and solar resources, access to the sea, a highly skilled and digitalised workforce with a solid engineering culture inherited from the past, cost-competitive manufacturing and available land.

Is Europe fully tapping into the industrial and innovation potential of Southeast Europe (SEE) to deliver the green transition by leveraging the potential of this region to the wider European competitiveness agenda? So far it has not been the case.

Our analysis shows that Europe is structurally underinvesting in the region with the fastest company growth in the EU. This funding imbalance is one of the reasons why Europe continues to struggle to scale innovative technologies and build competitive cleantech manufacturing across the continent.

This should be puzzling to any analyst, whether they are familiar with Europe or not. It reflects EU’s incomplete single market integration and miscoordinated industrial policy pointed out by the Letta and Draghi reports.

One thing is clear: for Europe to course-correct its downward trajectory in global cleantech competitiveness, it must rethink where and how it deploys its financing. This means no longer placing its bets on the same places, diversifying its strategy across the whole Union, and deploying cleantech scale-up capital where it can yield the highest benefits and fastest growth rates.

The EU cannot afford any more blind spots in its uncoordinated technology innovation strategy. A necessary starting point is to ensure that the next EU budget allocates sufficient resources for innovation to the high-potential regions that are currently overlooked.

A structural funding gap – EU funding analysis

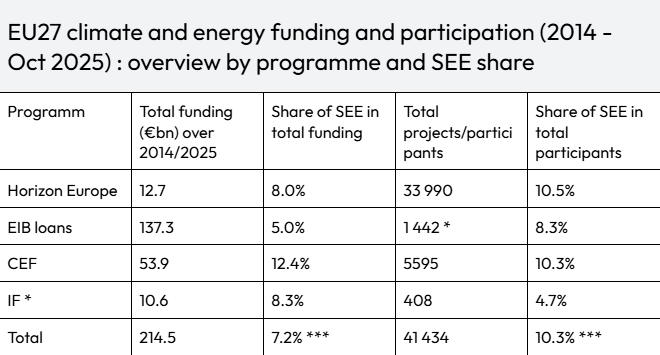

Across all EU-level public funding instruments analysed, Southeast Europe receives only 7.2% of total energy and climate funding, while representing around 10% of the EU population.

The gap is particularly stark in loan-based instruments from the European Investment Bank (EIB), where the region receives just 5% of total funding despite accounting for 8.3% of approved projects. SEE projects tend to be significantly smaller than the EU average.

This matters because the EU is now considering shifting more financing towards EIB instruments to scale-up cleatech manufacturing, at the expense of grant-based instruments. Should this be the choice going forward, then special attention must be paid to ensuring a geographical balance in the beneficiaries of these instruments, not only taking into account regional shares of the population, but also growth potential and industrial relevance.

This has to be a core element of the EU Competitiveness Compass if we are to leverage the dynamism of this region to the benefit of the whole EU. Failing to do so would risk reinforcing existing path dependencies and reproducing the same disjointed industrial policy, with obvious consequences in terms of stagnation or even worse, contraction.

By contrast, programmes relying more heavily on grants or blended finance show better outcomes for the region:

– Horizon Europe: SEE accounts for 10.5% of participants but only 8% of total funding — more projects, but smaller budgets.

– Connecting Europe Facility (CEF) is a notable success story, with the region securing 12.4% of funding, outperforming its demographic weight.

– Innovation Fund: SEE participation remains extremely low (4.7%), yet funding reaches 8.3% thanks to a handful of large industrial projects.

The pattern that emerges is that SEE performs better where grants are available, and significantly worse when investment relies primarily on loans.

* number of project lines, since the EIB data includes loans covering multiple projects and did

not display the exact number of participants or beneficiaries.

** for the Innovation Fund : 2021 – Oct 2025 only

*** weighted average across all programmes

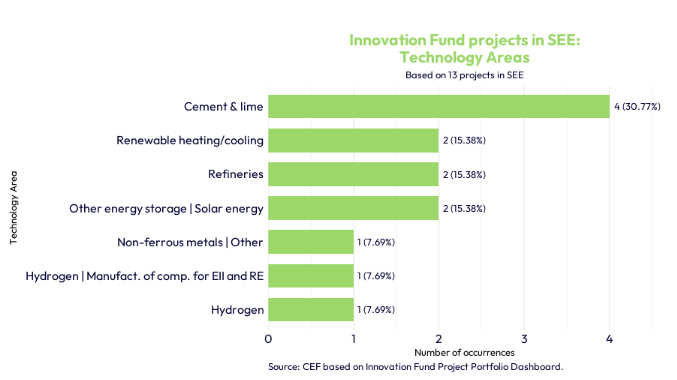

A deep-dive into Innovation Fund portfolio in SEE

The paradox is striking. The SEE region maintains a strong industrial base — around 20% of GDP for Bulgaria, Romania and Croatia, and 15% for Greece — yet it remains marginal in the Innovation Fund’s portfolio of transformative cleantech projects.

Several carbon-intensive and strategically important sectors are almost absent:

– zero projects in iron and steel,

– one project in non-ferrous metals (aluminium),

– one project in cleantech manufacturing, despite its centrality to EU supply chains.

Meanwhile, most SEE funding from the Innovation Fund concentrates in just five projects, mainly in cement decarbonisation coupled with CCS. With the upcoming free allocation phase-out in the iron and steel as well as aluminum sectors, this imbalance raises a deeper question. How can Europe ensure a balanced decarbonisation and green competitiveness if SEE industries are not properly represented in major EU industrial funding schemes?

A key issue for Europe’s future competitiveness

The next EU budget could reshape this landscape. The Commission has proposed a new European Competitiveness Fund. Under this proposal:

– InvestEU’s EU-level guarantee would jump to €70 billion, nearly three times today’s level.

– Energy infrastructure under CEF would benefit from close to € 30 billions, around 4 times the previous budget.

But bigger budgets will not automatically fix geographical imbalances.

SEE has all the ingredients to become a central pillar of Europe’s green industrial base: competitive labour costs, strong engineering talent, fast-growing companies, and proximity to EU manufacturing value chains. Yet the current distribution of EU funding does not reflect this potential. For example:

– Romania receives four times less EIB financing than expected based on its population share.

– Bulgaria has only one Innovation Fund project, and Romania none, despite high industrial exposure to the carbon price.

– Average green industry project size financed by the EIB in SEE is €16 million, versus €74 million in the EU27.

If the EU wants its Clean Industrial Deal, it cannot leave an entire industrial region behind.

What needs to change in the next EU budget – recommendations

The report’s recommendations converge on a clear objective: ensure that the Southeast European region becomes fully integrated into the EU’s cleantech and industrial transition — not marginal to it.

1. Rebalance geographic access to EU funds within the new Competitiveness Fund. SEE innovators need simplified, targeted access routes adapted to regional realities. The region displays above-average growth and startup valuation potential — but EU-level instruments do not yet reflect that.

2. Adapt financial instruments to SEE’s investment profile — and preserve grants. Given that SEE performs significantly better in grant-based programmes, at least 50% of cleantech allocations to SEE should be delivered as grants or blended finance, not purely loans.

3. Leverage the expansion of Horizon Europe to close the funding gap. SEE represents over 10% of Horizon beneficiaries but only 8% of the funding. The doubling of the Horizon budget in the next EU budget is a chance to correct the structural underfunding of research and innovation in the region.

4. Align Innovation Fund support with industrial realities. Countries with industrial sectors representing ~20% of GDP should see Innovation Fund allocations that match their decarbonisation needs — not one project every four years. The Innovation Fund’s Project Development Assistance should earmark specific support for SEE (e.g., 15%).

5. Diversify the Innovation Fund portfolio. Avoid overconcentration in a single sector such as cement. Support small and mid-scale renewable, hydrogen, efficiency, and manufacturing projects in SEE.

Strengthening cleantech investment in Southeast Europe is not only an issue of fairness — it is a strategic necessity for Europe’s industrial sovereignty. The next EU budget must correct long-standing structural imbalances to unlock the region’s full potential and ensure that Europe’s green industrial transformation is genuinely pan-European.

Check the Clean European Futures report for a detailed analysis.