Report

As the Euro prepares for take off: a critical review of the first three years of EMU

In a few weeks’ time the euro will become a day to day reality for nearly three hundred million Europeans, after having been a fact of life for the financial markets for three years. Foreword by Jacques Delors

STUDY PUBLISHED IN THE FORMER SERIES “EUROPEAN ISSUES”

FOREWORD BY JACQUES DELORS

In a few weeks’ time the euro will become a day to day reality for nearly three hundred million Europeans, after having been a fact of life for the financial markets for three years.

Although I played a part in this adventure of which I am proud by chairing the committee which gave birth to the euro, I must admit to being astounded by the political audacity of the resolute manner of its introduction. The “economic giant and political dwarf” that is Europe now has a place on the world stage by virtue of one of the primary tools that give the power to act.

And the first effects of this common power were not slow to be felt. Over the last three years, several international financial crises have occurred without bringing with them anything like the panic shown by the national authorities in previous similar circumstances. If a few despondent souls – often the same ones who were opposed to the principle of the single currency – set up a daily lament about the supposed “weakness” of the euro, it has to be said that as far as everyday life goes there doesn’t seem to be anything worth losing sleep over, which is in itself a considerable change.

Does this mean that by inventing “the currency without a state”, as Tommaso Padoa-Schioppa so neatly put it, we will have managed to square the circle? Not entirely. We have the tool to do the job, but as yet nothing that can wield it in order to achieve what remains the objective: a common economic prosperity. We have created an independent monetary authority, overtly federal in nature, but we remain divided and hesitant when it comes to using it in an optimal “policy mix” which would associate it with economic and budgetary policy in order to follow a controlled path for growth and employment. I have had many opportunities to say that this weakness of the economic aspect is not something I recognise as being “my” baby, nor yet its aim.

So what is to be done? Should we hope for salvation through a crisis which will force tighter economic integration? You would have to be something of a masochist. Should we wait wisely for the single European currency to create a European state? You would have to be a hopeless functionalist, and in any case that is certainly not the Europe that I am hoping for, absorbing everything, standardising everything. What remains is the path of effective coordination, which respects all the personalities involved and allows a concerted response to common challenges, without pushing all effective political activity up to the Brussels level.

This is the path which Lluàs Navarro explores here, in a detailed examination of the steps forward and the hesitations which have marked the first three years of existence of the single currency. From it he derives some realistic proposals, which call for discrimination and determination, but no fundamental upheaval, which is not what we need. It is a lucid vision with which I find my self wholeheartedly in agreement.

SUR LE MÊME THÈME

ON THE SAME THEME

PUBLICATIONS

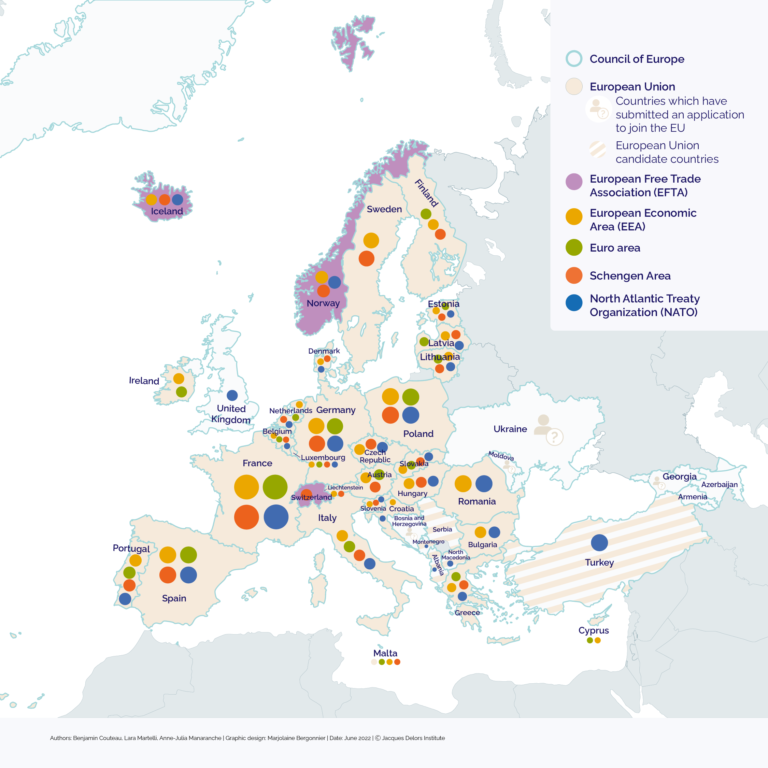

The war in Ukraine:

what are the consequences for European organisations?

After Brexit, euro-denominated derivatives transactions should leave the City

The Euro as seen by citizens who do not yet have it

MÉDIAS

MEDIAS

Marine Le Pen might be about to wreck the eurozone

L’Irlandais Paschal Donohoe reconduit à la présidence de l’Eurogroupe

Il y a vingt ans, l’arrivée des premiers euros